Government HELP loans

In this section

-

Helps eligible students in a Commonwealth Supported Place (CSP) pay their fees.

-

A loan that helps domestic students pay all or part of their tuition fees.

-

A loan to help pay for all or part of your student services and amenities fee (SSAF).

-

Assists students enrolled in a Commonwealth Supported Place (CSP) to study overseas.

-

Track your HELP debt, learn about limits and payments, and view frequently asked questions.

-

Assistance to encourage doctors and nurse practitioners to rural, remote or very remote areas of Australia.

-

Assistance includes waivers on accumulated HELP debt indexation, and reduction of accumulated HELP debt.

-

View frequently asked questions about Government HELP loans.

Additional resources

-

After each census date you will receive an electronic CAN, which details any amount sent to the ATO as a HELP debt.

-

Your lifelong education number with the Australian Government. You'll need it to be eligible for Commonwealth assistance.

-

The last day to finalise aspects of your enrolment and fee obligations for a study period, without incurring financial liabilities.

-

Information and the latest news on Australian Government assistance for students.

A HELP loan is a student loan and is very different to a loan from the bank. Unlike a bank loan, you are only required to pay back your HELP loan once your income reaches a certain amount or threshold known as the Compulsory Repayment Threshold. Once your income reaches that level, you need to start paying off your HELP loan even if you’re still studying.

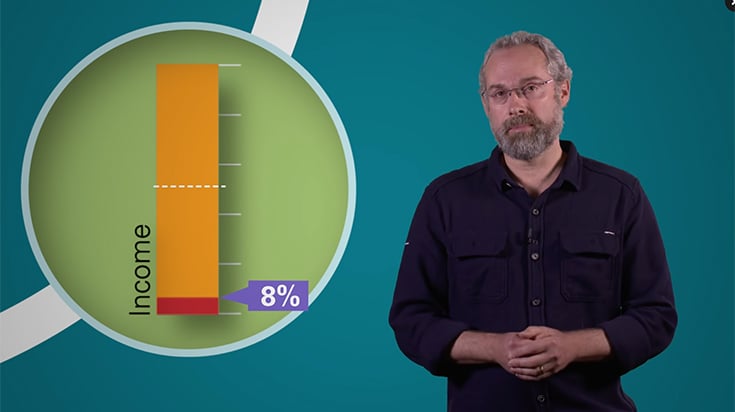

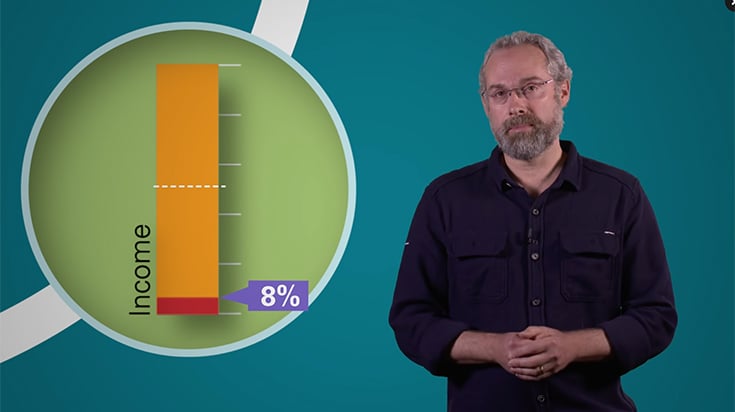

It’s important to know that you will still have a HELP debt even if you don’t complete your study. When you are repaying a HELP loan, the rate you have to pay will depend on how much you earn and varies from 2% to 8% of your income. The Australian Tax Office or ATO will calculate your repayments based on your income.

Before you access a HELP loan, make sure you understand your obligations around repaying the loan and stay informed about any changes to the HELP scheme and how they could affect your repayments.

[Hannah – fourth year law student]

I chose to take out a HELP loan to pay my tuition fees because I wasn’t in a position to pay for my studies upfront and neither were my parents. When I finish studying this year I will have a $20,000 HELP debt, here is what my payments my look like. If I work fulltime and earn a salary of $55,000 a year, 2% of my pay will go towards repaying my HELP loan. This is taken out of my pay along with regular tax payments. This means I would be making repayments of $1,100 a year towards my HELP debt, which is about $42 a fortnight.

I know that when my salary increases, so will my HELP debt repayments. Each year my HELP debt will increase because of indexation which reflects increases in the cost of living. If I decide to take on more debt, like buy a car, I will need to include my HELP loan repayments in my budget. If I decide to move overseas to work I will still have to make repayment to my HELP debt.

It is important to make informed financial decisions so I will do my research starting with the money smart website before making any financial commitments. A HELP loan is a great way to pay for your study, but it is a loan so make sure you know what is involved. To find out more about HELP loans search online for Study Assist or visit studyassist.gov.au.

A HELP loan is a student loan and is very different to a loan from the bank. Unlike a bank loan, you are only required to pay back your HELP loan once your income reaches a certain amount or threshold known as the Compulsory Repayment Threshold. Once your income reaches that level, you need to start paying off your HELP loan even if you’re still studying.

It’s important to know that you will still have a HELP debt even if you don’t complete your study. When you are repaying a HELP loan, the rate you have to pay will depend on how much you earn and varies from 2% to 8% of your income. The Australian Tax Office or ATO will calculate your repayments based on your income.

Before you access a HELP loan, make sure you understand your obligations around repaying the loan and stay informed about any changes to the HELP scheme and how they could affect your repayments.

[Hannah – fourth year law student]

I chose to take out a HELP loan to pay my tuition fees because I wasn’t in a position to pay for my studies upfront and neither were my parents. When I finish studying this year I will have a $20,000 HELP debt, here is what my payments my look like. If I work fulltime and earn a salary of $55,000 a year, 2% of my pay will go towards repaying my HELP loan. This is taken out of my pay along with regular tax payments. This means I would be making repayments of $1,100 a year towards my HELP debt, which is about $42 a fortnight.

I know that when my salary increases, so will my HELP debt repayments. Each year my HELP debt will increase because of indexation which reflects increases in the cost of living. If I decide to take on more debt, like buy a car, I will need to include my HELP loan repayments in my budget. If I decide to move overseas to work I will still have to make repayment to my HELP debt.

It is important to make informed financial decisions so I will do my research starting with the money smart website before making any financial commitments. A HELP loan is a great way to pay for your study, but it is a loan so make sure you know what is involved. To find out more about HELP loans search online for Study Assist or visit studyassist.gov.au.