MAI728 - Financial Behaviour and Decision Making (Intensive)

| Year: | 2025 unit information |

|---|---|

| Enrolment modes: | Not offered in 2025 |

| Credit point(s): | 1 |

| EFTSL value: | 0.125 |

| Cohort rule: | This unit is only available to students enrolled in N002*, M512, M769, M669, M569, M701 and M640 |

| Prerequisite: | Nil |

| Corequisite: | Nil |

| Incompatible with: | MAA728, MAF714 |

| Study commitment | Students will on average spend 130 hours undertaking the teaching, learning and assessment activities for this unit. Students will have 24 hours of face-to-face contact over the course of 4 consecutive days with separate independent and collaborative learning required both prior to and subsequent to the Intensive. Students will be required to access the Unit Site for reading and preparation work which will be available four weeks prior to the commencement of the intensive. In addition to the online activities, this intensive unit requires students to attend four consecutive days of intensive study via Zoom. This will include educator guided online learning activities within the unit site. |

| Scheduled learning activities - online | This intensive unit will be run via a virtual classroom format through Zoom from 9.00am to 2.00pm over four consecutive days. |

| Note: | *N002 (single unit non-award postgraduate) How to apply Current Deakin students can enrol directly via StudentConnect. Please enrol by the deadline as places are limited. For further information please email financial-planning@deakin.edu.au |

Content

The Financial Planning professional must be able to build a deep understanding of their client’s needs and be able to anticipate issues many clients may not have considered. This unit builds on the technical knowledge acquired in other units, to broaden students’ understanding of the professional skills and knowledge required to manage long-term client relationships, and develop comprehensive understanding of clients’ needs in order to formulate strategies and solutions that are in the client’s best interest.

Drawing on insights from the behavioural sciences, this unit requires students to develop strategies to build trust, communicate the value of advice, and engage clients at each stage of the financial planning process. Students will be introduced to the field of behavioural finance, to develop an understanding client behaviour and factors that influence decision-making. The unit also seeks to provide students with a theoretical and practical understanding of the ethical and professional requirements within a financial services context.

Unit Fee Information

Fees and charges vary depending on the type of fee place you hold, your course, your commencement year, the units you choose to study and their study discipline, and your study load.

Tuition fees increase at the beginning of each calendar year and all fees quoted are in Australian dollars ($AUD). Tuition fees do not include textbooks, computer equipment or software, other equipment or costs such as mandatory checks, travel and stationery.

For further information regarding tuition fees, other fees and charges, invoice due dates, withdrawal dates, payment methods visit our Current Students website.

How to apply

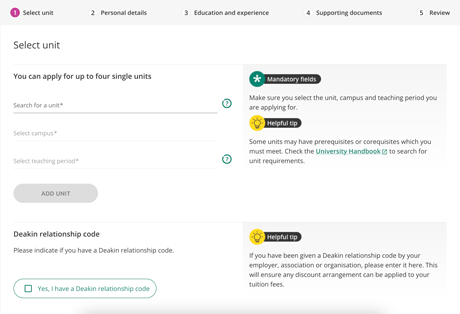

You can apply online for this single unit via the Deakin Applicant Portal. Enter the unit code above and follow the steps to submit your application online. Once submitted, we'll be in contact via email to confirm your place.

You can apply for multiple units in one trimester in a single application or to study multiple units over subsequent trimesters, you'll need to submit a separate application for each study period.